> haternomics

Confessions Of An Economic Hate Crime

If the financial crisis is a hate crime with an ever-expanding class of victims, the Beltway bro-taucracy is the neoliberal neo-Klan

Back in January 2003 a law professor named Cecil J. Hunt published a in the Toledo Law Review explaining the explosion in subprime mortgage lending as an "economic hate crime" of industrial scale. Opening with a wry reference to the play A Raisin in the Sun, which Lorraine Hansberry wrote about her family's ultimately successful real-life legal battle to move into the house they'd purchased in a white neighborhood in the late thirties:

Imagine what might realistically have become of the powerful matriarch, Lena Younger, and her fragile little family over the course of the next forty years in suburban white America. As the children grew up, the whites would have abandoned the area and fled to whiter and more distant enclaves, and the neighborhood would have shifted from all white to virtually all Black. Real estate values would have stagnated while neighboring white areas would have flourished and greatly appreciated. Long after the children had grown and moved away, Lena would have paid off the mortgage and settled into a comfortable retirement on a fixed income. She would also have been aggressively and racially targeted by units of some of the largest banks in the country for high cost predatory loans that would have slowly stripped away virtually all of the equity she had built up in her home over the many years of hard work and sacrifice. Eventually, with her equity depleted and the costs of the new mortgage nearing or exceeding her fixed monthly income, Lena would have lost her little dream house through foreclosure and become another homeless statistic living on the street or surviving through the kindness of strangers or family [*212] members. What had begun so hopefully as part of a non-racialized American Dream, would have ended tragically as part of an emerging and highly racialized American Nightmare.

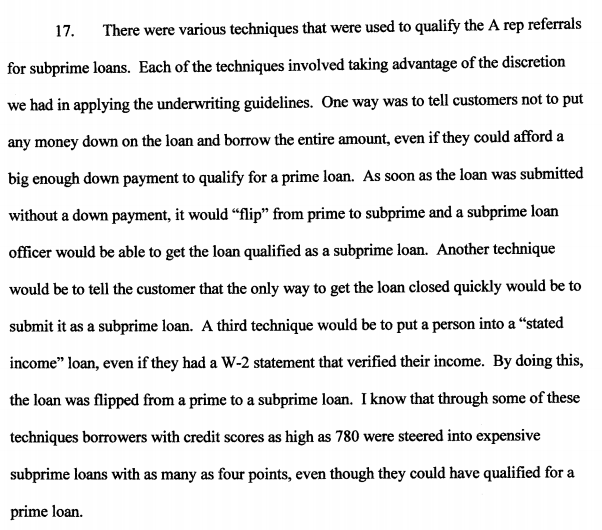

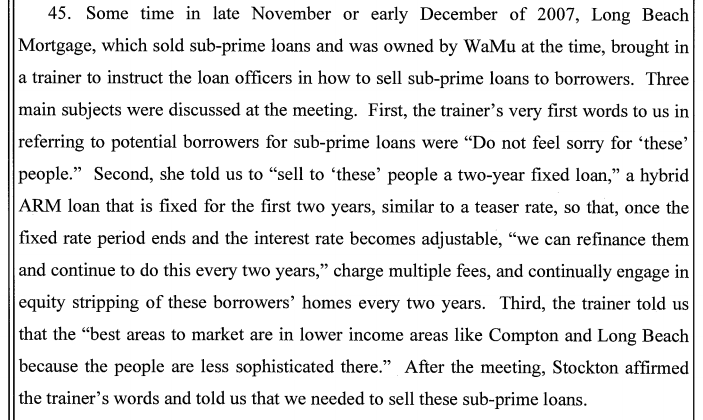

This was, at the time, not only a "groundbreaking" analysis, it was entirely correct. Subprime mortgage lenders were infesting minority zip codes at an unprecedented pace with precisely that scenario in mind. And as we know the 2010 testimony of former Washington Mutual loan officer Greg Saffer, the first thing you learn in equity stripping academy is "not to feel sorry for 'these' people."

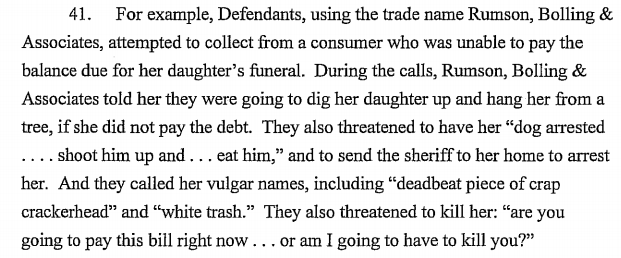

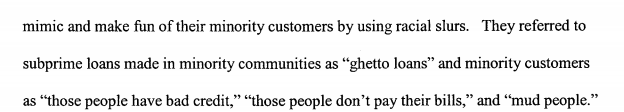

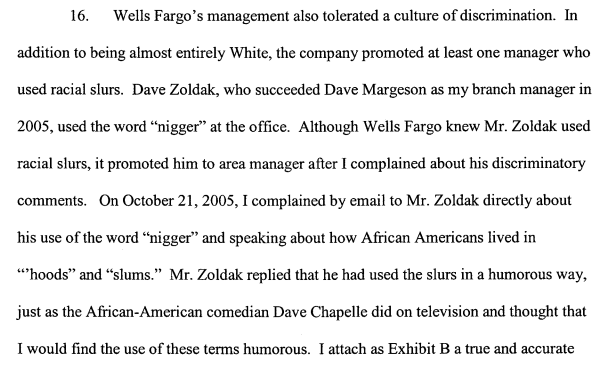

"'These' people" were also known as "mud people" at Wells Fargo, as former loan officer Tony Paschal explained under oath in 2009:

And…

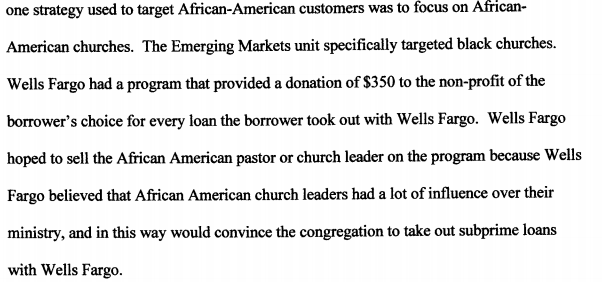

Although never in church, as former Wells Fargo sales manager Elizabeth Jacobsen explained in her affidavit:

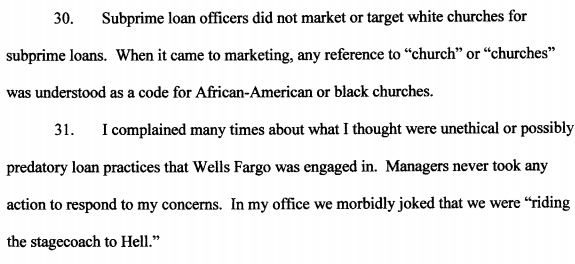

Caucasian church leaders were not perceived to have commensurate influence over their congregations, perhaps because Caucasians generally perceive the consequences of their actions as safely anchored in the afterlife:

I am not sure whether this means Wells Fargo flyers addressed prospective customers in minority-heavy zip codes with visions of the all the top shelf cognac and aftermarket auto accessories their home equity might purchase…

…but it was probably a helpful way of determining whether a customer with a good job and a high credit score might be secretly "subprime":